Latest News

Health Rates

VEHI Communications (Campaign Monitor) Archive

Health Plan Resources for Employers

Health Plan Resources for Employees

About Us

What is VEHI?

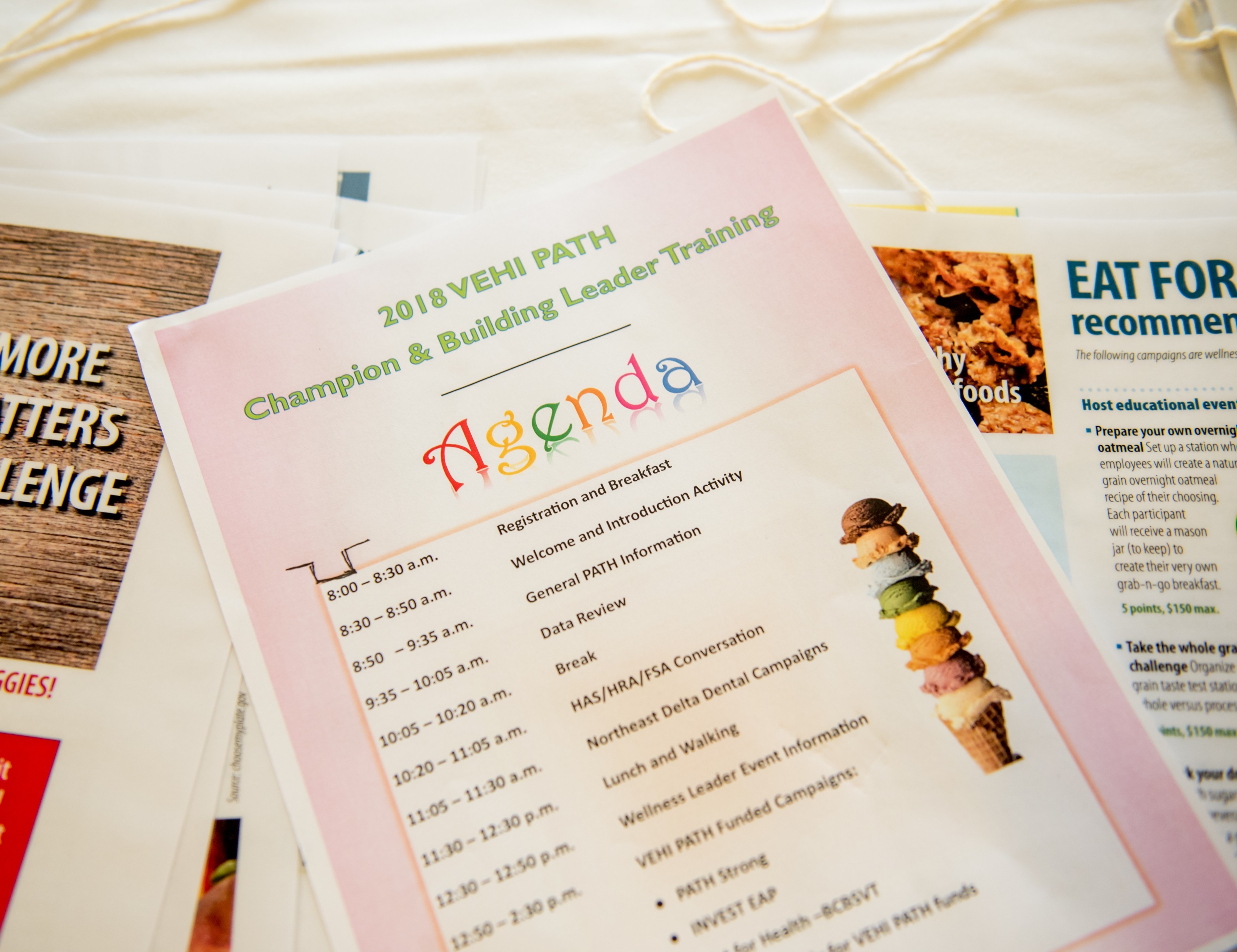

The Vermont Education Health Initiative (VEHI) is a non-profit organization that, for more than two decades, has served school districts by offering employee benefit plans responsive to the needs of both employers and employees and their dependents. VEHI also provides health insurance benefits to retired teachers and their dependents through the Vermont State Teachers’ Retirement System.